.

.

Date’s cultivation relates back as far as 7000 BC in Middle Eastern countries.

Date is considered as a staple food especially among Muslim people as it is full of vitamin A, thiamine and complex of vitamin B, vitamin C, vitamin E, vitamin K, as well as minerals including calcium, iron, magnesium, manganese, phosphorus, potassium, sodium and zinc.

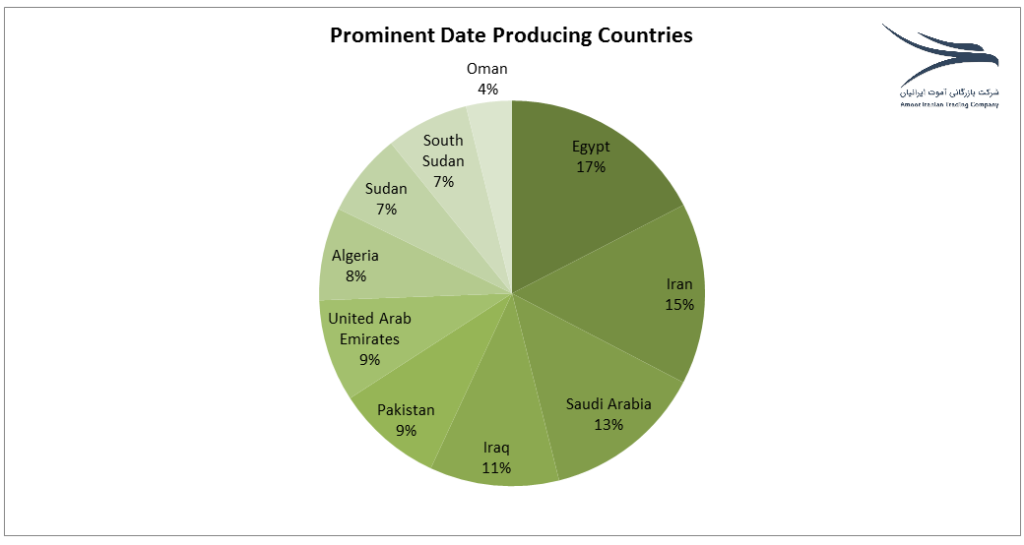

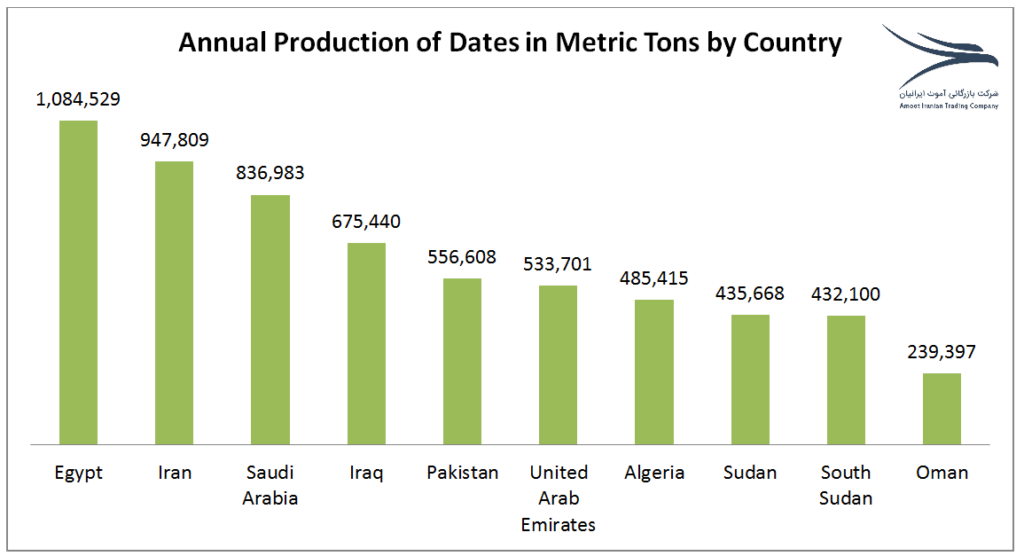

Dates are grown in arid and semi-arid places that have long, hot summers with little to no rainfall. The world’s leading countries in date’s cultivation are demonstrated in bellow charts.

.

.

.

As charts are showing Egypt is the first date’s producing country by cultivation of 1,084,529 metric tons of dates per year, allocating about 17% of global date’s production to itself.

But only about 3% of the date’s world export is related to Egypt. Morocco (53%), Indonesia (24%) and Malaysia (15%) are the main importers of Egypt dates respectively.

.

Iran is the second top producer of dates globally by cultivation of 947,809 metric tons of dates annually.

About 7.7% of date’s total world export is related to Iran. Iran is globally popular in cultivation of various types of dates including Mazafati (Rotab), Piarom, Gantar, Estameran, Shahani, Zahedi, Kabkab, Rabbi, Khazravi, Mordasang and etc.

.

Asian countries like India, UAE, Pakistan and Malaysia are the main consumers of Iran dates. Moreover Iran date is well-known in many European countries including Russia, Turkey, Germany, Sweden, Denmark and England as well as American countries like Canada.

It is important to note that among European countries, Russia is the main purchaser of Iran dates by importing about 9.9% of Iran’s exported dates.

.

Following Iran, Saudi Arabia is the third producer of dates by cultivation of 836,983 metric tons of dates per year. The main buyers of its dates are Jordan (19%), Yemen (17%), and Kuwait (15%).

.

Iraq is the fourth cultivator of dates by producing 675,440 metric tons annually and is responsible for 7.3% of global date export. Near 80% of Iraq dates are exported to India. Pakistan, UAE, Algeria, Sudan, South Sudan and Oman are respectively the next main producers of dates.

.

Amoot Iranian Trading Company located in Iran is exporting various types of dates, especially Mazafati date (Rotab) to numerous countries around the globe.

We are endeavoring hard to meet all customers’ expectations regarding quality, price and service.

Proudly Amoot Iranian Trading Company is extending its customers in various parts of the world, from Asia to Europe. India, China, Pakistan, UAE, Turkey, Russia, Germany, Sweden, England and etc. are some of Amoot main importers of dates.

Our experts are keen to provide any required information for all date’s buyers around the world so simply send us a message to receive all details as fast as possible.