.

The fertilizer industry in Russia is a significant contributor to the country’s economy, with several major companies dominating the market.

The industry primarily produces nitrogen-based fertilizers, with exports to US, Europe and Asia accounting for a large portion of their sales.

.

Is Russia a Big Fertilizer Producer?

Yes, Russia is a significant producer of fertilizers, with several major companies operating in the industry.

.

While oil and gas are Russia’s largest exports, the country is also a major player in the global fertilizer market.

The country is particularly known for its production of nitrogen-based fertilizers, which are widely used in agriculture worldwide.

.

Who Is the Biggest Exporter of Fertilizer?

According to the latest available data from the World Trade Organization, the biggest exporter of fertilizer is Russia.

.

Other major fertilizer exporting countries include China, the United States, Saudi Arabia, and Canada.

The demand for fertilizer is driven by global agriculture and the need to increase crop yields, and these countries are key players in meeting that demand.

.

2022

According to the Russian Federal Customs Service, Russia’s fertilizer exports rose significantly by 54.3% in 2022, reaching a value of $19.295 billion.

The report also indicated an increase in fertilizer imports, which reached $351.6 million during the previous fiscal year, as per the Sputnik news agency.

.

2021

In 2021, the value of Russia’s fertilizer exports reached $13.1 billion, solidifying its position as the largest exporter of fertilizers globally.

Moreover, fertilizers were ranked as the fourth most exported product from Russia during the same period.

Brazil ($3.57B), United States ($1.04B), China ($891M), Estonia ($767M), and Finland ($561M) were the main destinations of Russia’s fertilizers in 2021.

.

2020

In 2020, Russia held the largest share of global ammonia exports among other types of fertilizers, accounting for nearly one-quarter of the world’s total ammonia exports.

Additionally, Russian exports of urea made up 15% of the world’s total exports of this fertilizer.

Between 2020 and 2021, the Russian fertilizer industry experienced significant growth in its exports to Brazil, which increased by $2.14 billion, as well as to the United States, with exports rising by $600 million, and China, where exports increased by $360 million.

These countries are among the fastest-growing export markets for Russian fertilizers, indicating a strong demand for these products in those regions.

.

2019

In 2019, 19% of the world’s potassium fertilizers came from Russia along with 15% of the world’s nitrogen fertilizers and 14% of phosphorous fertilizers.

.

Who Is the Biggest Exporter of Urea?

In 2021, the leading exporters of urea were Russia, with exports worth $2.51 billion, followed by China with $2.32 billion, Oman with $2.07 billion, Qatar with $1.96 billion, and Saudi Arabia with $1.76 billion.

These countries are among the largest producers and exporters of urea-based fertilizers, contributing significantly to the global trade in this product.

.

What Types of Fertilizer Does Russia Export?

Russia primarily exports nitrogen-based fertilizers, such as urea, ammonium nitrate, and ammonia.

These fertilizers are widely used in agriculture for their ability to increase crop yields, and they represent a significant portion of Russia’s overall fertilizer exports.

However, the country also produces and exports other types of fertilizers, including phosphorus-based fertilizers like diammonium phosphate (DAP) and monoammonium phosphate (MAP), as well as potassium-based fertilizers like potassium chloride (potash).

.

Who Buys Russian Fertilizer?

As the largest exporter of fertilizers globally, Russia typically ships significant volumes to major markets like the US and Brazil.

However, between January and October 2022, US imports of Russian urea decreased by 42% compared to the previous year.

While the decline has persisted for several months, it has only recently fallen below levels seen in previous years.

Russia is the world’s biggest exporter of fertilizers, with large volumes typically shipped to the US and Brazil.

.

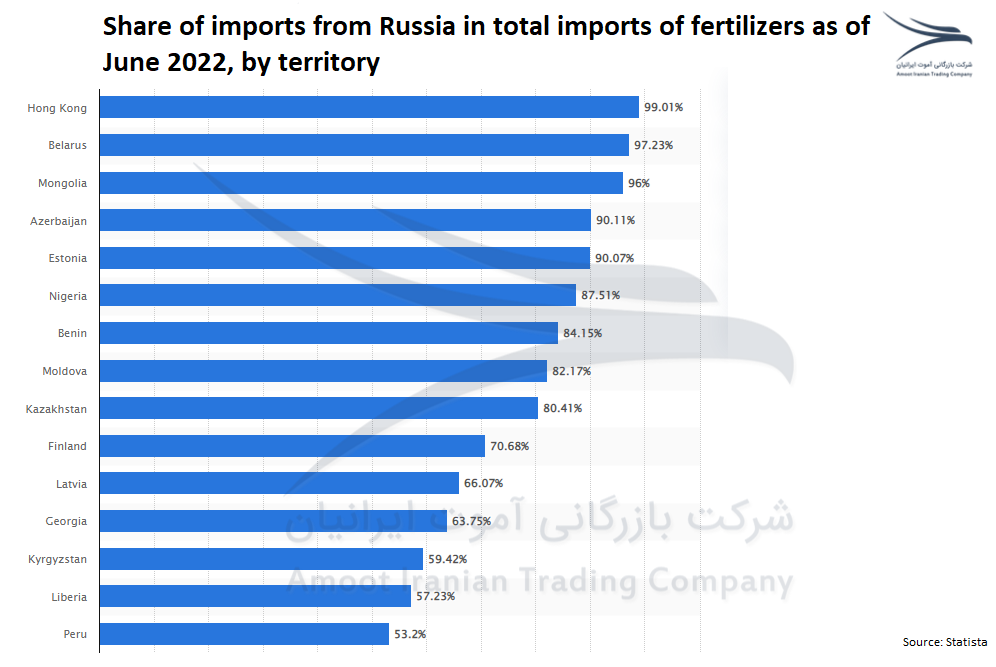

The countries Importing Over 50% of their Fertilizers from Russia as of June 2022

Hong Kong and Belarus have been highly dependent on Russia for their fertilizer imports.

.

Hong Kong relied on Russia for 99 percent of its fertilizer imports, which was the highest dependence rate among other global territories.

Belarus followed with 97 percent of its fertilizer imports coming from Russia.

.

This high level of dependence on a single supplier can make these countries vulnerable to supply disruptions or price increases, highlighting the importance of diversification in the fertilizer market.

.

.

As you can see above, the other countries that import over 90% of their fertilizers from Russia are Mongolia, Azerbaijan, and Estonia as of June 2022.

Others that import between 50% to 90% of their fertilizers from Russia can be seen in the table above.

.

Is Russian Fertilizer Sanctioned?

The sanctions imposed by the European Union (EU) do not apply to Russian exports of food supplies and fertilizers, whether to EU or non-EU markets.

The goal of this policy is to avoid targeting the fertilizer industry as a whole. However, there is an exception for potash, which is subject to restrictions under EU sanctions against Russia.

The ongoing conflict in Ukraine and the resulting sanctions have had an impact on Russia’s fertilizer industry.

.

.

Some Russian fertilizer producers have been subject to sanctions, and the overall volume of fertilizer exports from Russia has decreased in recent years. In addition, the cost of natural gas, which is a key input for fertilizer production, has been increasing in Russia and other parts of the world.

This has added to the challenges faced by Russian fertilizer producers, as it has raised the cost of production and reduced their competitiveness in the global market.

However, In the past year, Russia itself has implemented various measures to restrict exports of fertilizers and agricultural products, including:

- export taxes

- licensing requirements

- actual bans

.

For instance, Russia banned wheat exports to other countries in the Eurasian Economic Union to prevent exporters from exploiting the free trade zone and avoiding increased export taxes.

.

Additionally, Russia has introduced export licensing requirements for nitrogen-based fertilizers, including compound fertilizers, in 2021.

While these measures may not amount to complete export bans, they still place limits on exports and increase costs for importers

It potentially reduces the demand for Russian fertilizers.